Optimized Future Blueprint™

Optimized Future Blueprint™ Process

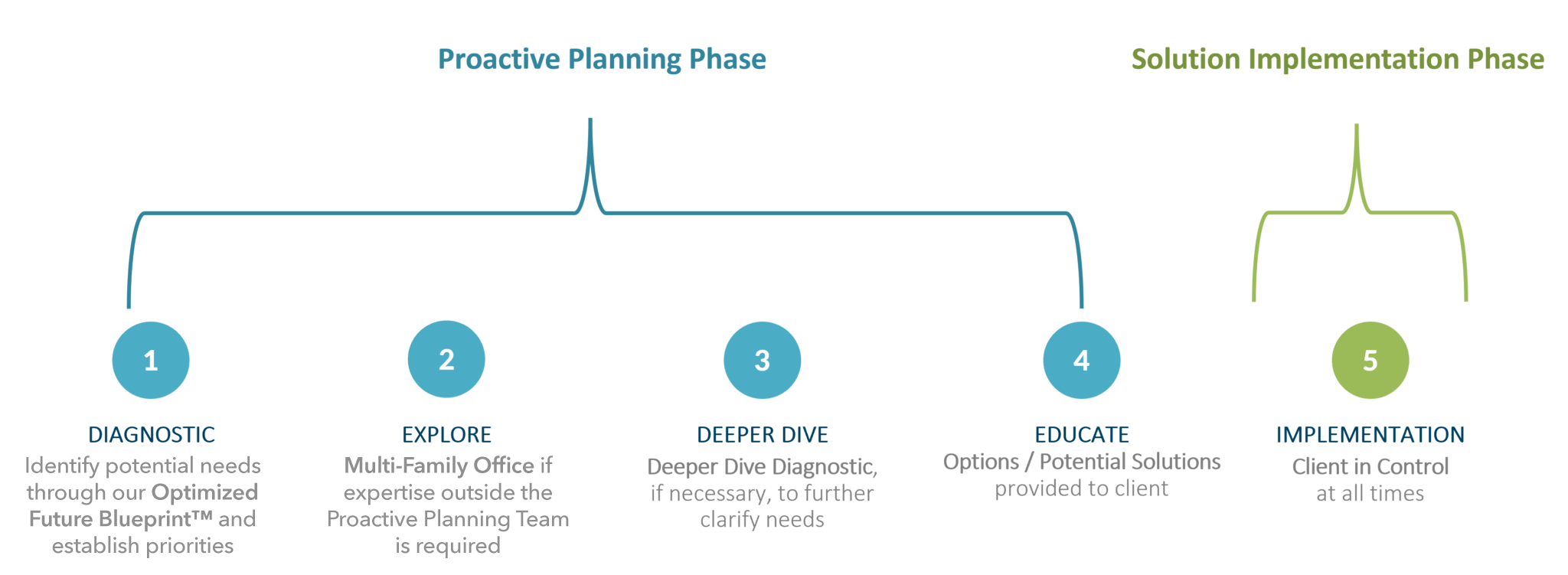

5 Step Process Overview

Step 1. Diagnostic:

We start with listening and learning about you to identify your goals, priorities, and challenges. We’ll also establish what you can expect from us and if an ongoing partnership is the right fit

Steps 2-4. Explore – Educate:

Strategy and tactics are very different. At this step, we are mapping out your strategy made up of multiple tactics. For example, often times a conversation with a wealth manager pivots to an asset allocation conversation much too early. An asset allocation is not a strategy nor is it a plan. This part of the process is to define your current state (your point A) so that we can develop roadmaps to your future state and often multiple future states (your point B’s). There are often tradeoffs between different future states. And here we rely on our fintech and analytics expertise as well as partner with your accountants and attorneys to gain a holistic understanding of your financials to establish your Optimized Future BlueprintTM.

Step 5. Implementation:

Powerful people make powerful choices. Once your Optimized Future BlueprintTM has been developed, you decide how much help you would like from us in implementing none, part, or all of the strategy. We empower you with the insights, knowledge, and information on your finances, but we put the power of choice in your hands on your desired engagement level on an ongoing basis.