Tax Planning

Taxes is Your Single Largest Expense

Tax Strategies that Work for You

If a household were to review their expenses, they would easily find that taxes are the single largest expense over their lifetimes. It would easily be larger than the cost of purchasing a house or paying for their child’s college. Taxes must be considered in the context of the overall financial plan and strategy. Every dollar that is saved means a dollar that can go towards retirement savings, spending, or passing to heirs, beneficiaries, and charity.

Some CPAs do little more than record history, simply focused on putting the right numbers in the right boxes. There is a big difference between preparing tax returns and doing proactive tax planning. True tax planning requires a team of top-notch professionals that scour the eighty thousand plus pages of the IRS tax code looking for every legal deduction and loophole available to minimize your income taxes, estate taxes, and capital gains taxes.

Tax Strategies to Move Your Business Forward

Many of our clients save many times the fee in reduced tax liability through careful planning and legitimate tax strategies.

Tax Planning in Turbulent Times

Strategizing for Potential Rate Shifts and Fiscal Policies

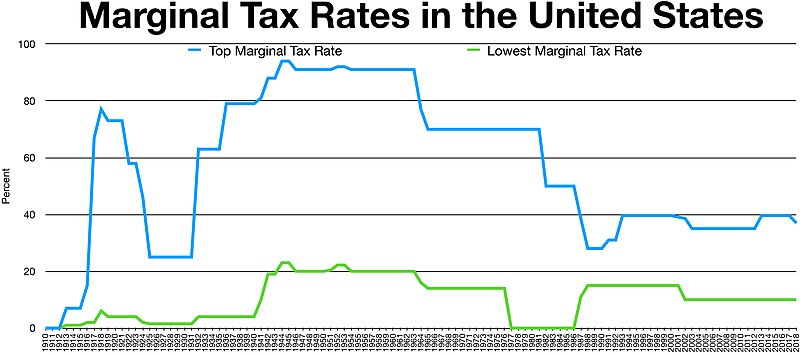

Believe it or not, we are currently at a relative low point in tax rates. However, we have seen recent record government expenditures in massive social programs and financing of defense programs which have historically precipitated increases in tax rates across the board. Part of our fiduciary responsibility is to review your tax situation in the context of your overall financial plan and strategy.

Strategic Tax Mastery

How Optura Advisors Helps Navigate Complexities for Long-Term Success

Optura Advisors specializes in addressing taxes from both a tactical and strategic perspective. There are tactics that can be employed in the current year and then strategies that span multiple years to properly position your portfolio and financial life as it relates to your tax objectives. Please reach out if you would like to understand the difference between strategic and tactical tax planning and to see which would apply to your situation.